AIFMP-CRISIL report says packaging industry requires agility

The report states the fundamental drivers—consumption and investment demand—continue to gain momentum.

04 Feb 2025 | 1702 Views | By WhatPackaging? Team

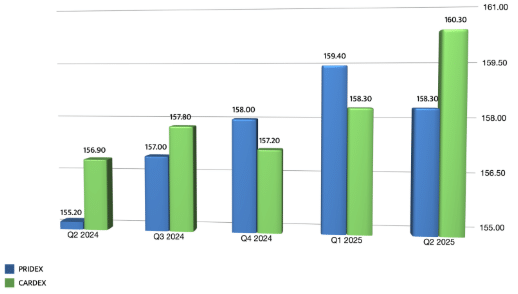

The latest numbers from the AIFMP-CRISIL report for Q2 2025 (July-September 2024) alludes to the fact that India's growth is intact but it is under pressure. The report states, the Pridex is at 158.30, and the Cardex settled for 160.3. Year-on-year (Q2 2024 to Q2 2025), Pridex has increased by 2%, while Cardex has recorded an increase of 2.17%. Since Q2 2024, Pridex has recorded a steady increase until the last quarter (Q1 2025, April-June 2024), dipping slightly (-0.69%) in the current quarter. The Cardex has recorded a steady increase between Q4 2024 and Q2 2025. The Cardex has gained 1.26% (quarter to quarter).

The future projections for the AIFMP-CRISIL indices, Pridex and Cardex, appear promising when analysed using historical data. Since its inception in 2013, both indices have displayed a gradual yet consistent upward trajectory, serving as critical indicators of the evolving dynamics within the print and packaging industry in India. The Pridex, reflecting input costs associated with commercial printing, and the Cardex, monitoring carton packaging costs, have, over the years, indicated a resilient market characterised by moderate yet steady growth.

Sanjay Patel, the project-in-charge of AIFMP-CRISIL Indices, said "The future is hopeful and that is a good sign for the print and packaging industry." Patel said, "Rural consumer demand has continued to support the consumption story and the premium-product-led growth of the FMCG markets, much like other sectors, including automobiles, clothes."

He added, "We can learn from the FMCG industry’s agility and strategy. They have achieved exceptional control over their upstream and downstream supply chains, which helps them control costs without compromising their agility and averting the risk of disruption."

Historically, the indices have shown a capacity to respond to market fluctuations, maintaining a trajectory that suggests an adaptable industry landscape. For instance, the recent year-on-year increases—2% for Pridex and 2.17% for Cardex — illustrate a continued recovery and growth phase, reinforcing the notion that the sector is effectively navigating through challenges posed by external economic pressures. The slight dip in Pridex during Q1 2025 does raise caution, though it appears to be a transient adjustment in an otherwise upward trend. As economic factors stabilise, it is conceivable that both indices will rebound, potentially leading to further increases in the coming quarters.

Sanjay Patel told WhatPackaging magazine that "The historical data suggests that the print and packaging industry can expect continued growth despite cost pressures, driven by key economic indicators such as rising consumer consumption and manufacturing output."

Patel continued, "Packaging growth has done well and wonders for many a business in our industry; however, with a little bit of market correction in the face of higher inflation, lower demand for our clients’ products, and rising input costs for us, we must be cautious to guard our margins and remain profitable in the short-term."

In summary, the historical data from the AIFMP-CRISIL indices suggest a robust outlook for India's print and packaging industry, with both Pridex and Cardex reflecting an upward trend indicative of resilience and growth potential.

These indices, with a base value of 100 for the fiscal year 2013-2014, are updated quarterly on the AIFMP-CRISIL indices’ page.The detailed methodology for computing Pridex and Cardex is available at https://tinyurl.com/yaqrr65m.