The food and drink industry: An Indian context

In this two-part series, Mintel’s Rushikesh Aravkar explores the evolving trends in food packaging and examines how Indian consumers perceive eco-friendly packaging and their preferences for sustainable features

23 Aug 2023 | By Rushikesh Aravkar

In the previous article, we noted that Indian consumers know the importance of protecting the environment but still need to walk the talk. The value-action gap when it comes to acting in an environmentally friendly manner is due to several factors, including a lack of convenience, affordability, accessibility, and trust. While promoting eco-friendly packaging, it is important for brands to emphasise cost- effectiveness and convenience, and lead with features that consumers value. What is consistent is that consumers seek non-plastic packaging instead of single-use plastic. Food and drink shoppers are very interested in packaging that retains freshness and resealability features.

Indian consumers demonstrate a willingness to pay a premium for eco-friendly packaging, with 50% considering a 1-10% increase reasonable, and 17% willing to pay an additional 11-20% premium according to Mintel research. This consumer sentiment underscores the need for brands to increase their commitment to responsible packaging.

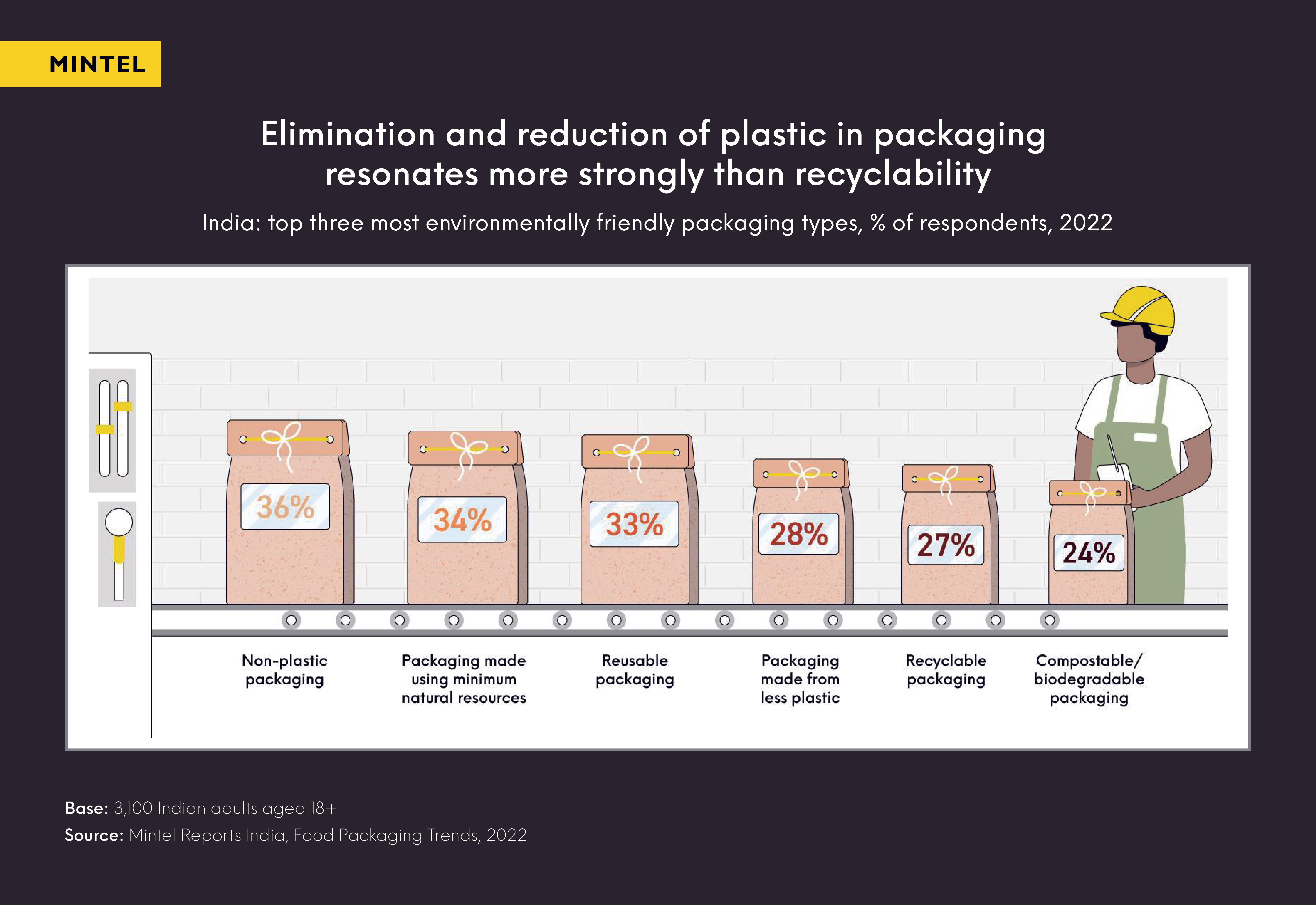

In India, the elimination and reduction of plastic in packaging resonate more strongly than recyclability. The top three environmentally friendly packaging types preferred by consumers are non-plastic packaging, packaging made with minimal natural resources, and reusable packaging.

Responsible packaging allows marketers to address customer concerns by reducing packaging waste and improving environmental friendliness. However, Indian consumers are not engaged with brands’ marketing efforts in connection with recycling because of the lack of recycling infrastructure and clear instructions.

New-age food/drink brands focus on “plastic neutrality” in on-pack messaging. Plastic neutral means the amount of plastic produced/used by brands is collected and recycled from the environment. Another option would be to eliminate plastic completely and go for other packaging like recyclable aluminium. Paper packaging is also a good alternative to plastic.

Plastic packaging options should never be overlooked just because they are plastic. Though consumers expect brands to eliminate or reduce plastic, when it is used, an explanation of why it is the more appropriate material/format for this occasion, this region, or this point in time is paramount.

Packaging that can be returned to stores or reused is considered environmentally friendly by consumers. Over a third (34%) of Indian consumers view packaging made with minimal natural resources as the most eco-friendly option. Refill options, for instance, can reduce the use of plastic. Brands should also need to educate consumers that the reduction of packaging material, in general, can reduce environmental impact.

While Indian consumers prioritise freshness retention, convenience, and digital connectivity in packaging, they also expect front-of-pack nutritional information, transparent packaging or

windows, and ingredient images on the back. Indian consumers also want maximum value from their packaging, with 38% saying they want

packaging that dispenses 100% of the product.

Packaging that keeps food fresher for longer can be positioned as a way to help shoppers make the most of their food budgets. Brands can overtly communicate the benefits of resealable packaging, especially for larger value packs that consumers take longer to consume. This approach improves the overall consumption experience and provides good value for money to attract and retain consumers.

Compliments' cereal pack is a unique and convenient resealable half-zip bag format that helps maintain freshness and eliminates the exterior box (Canada). Source: Mintel GNPD

As part of a post-pandemic interest in health means, Indian consumers are now more discerning about what they eat. According to Mintel research on Healthy Snacking, snacking healthily is an urban phenomenon prominent in metros and tier-1 cities in India. In these regions, at least 4 in 10 consumers express a desire for front-on-pack nutritional information, particularly on mainstream categories like biscuit packaging (49% and 42%, respectively). Nutritional labels can therefore be an effective tool for brands to differentiate their products nutritionally. Brands can also provide nutritional information via digital connectors such as QR codes.

For Valentine's Day, Center Fresh launched a limited-edition mono pack with a tiny QR code, which users could scan to create a personalised playlist and share with loved ones (India). Source: Instagram

Transparency will play a crucial role in the purchasing of functional food and drink. Mintel 2023 Global Food and Drink Trend Minimalist Messaging highlights that clean packaging designs that state essential selling points, but stand out from the competition, will appeal to shoppers who feel too much information makes it hard to choose. Mintel Global Consumer research also shows that 45% of Indian consumers aged 18-44 strongly agree that warning labels on products are useful in determining if a food or drink product is healthy. Moving ahead, consumers will increasingly expect packaging to deliver on freshness, convenience and eco-responsibility, while the product itself must offer quality, affordability, and value.