AGI’s Rrajesh Khosla on India’s cosmetics market and glass packaging

Rrajesh Khosla, CEO of AGI, discusses the booming cosmetics market in India, the growing role of male grooming, the importance of glass in packaging, AGI's commitment to sustainability, technology upgrades, and investments in both domestic and export markets.

25 Feb 2025 | By Ramu Ramanathan

Ramu Ramanathan (RR): What is your view about the cosmetics market, and your role at Cosmoprof India 2024?

Rrajesh Khosla (RK): India's cosmetics market, valued at approximately USD 15-billion, is experiencing significant growth, driven by social and economic factors. Increase in women empowerment across various sectors is contributing to this expansion. At Cosmoprof India 2024, we aim to showcase our innovative packaging solutions that cater to this dynamic market and support its continued growth .

RR: True. What about male grooming?

RK: The growing male grooming market reflects a broader understanding of the benefits of personal presentation. Cosmetics are now seen as a universal tool for enhancing self-confidence and making a positive impression, which can have a significant impact on both personal and professional life. This trend is driven by a growing desire for self-improvement and self-expression.

RR: Why is glass so crucial to the cosmetics industry?

RK: In the cosmetics industry, where purity and premium image are paramount, glass is the ideal packaging material. Its inertness ensures that delicate formulations remain uncontaminated, while its inherent elegance elevates brand perception. AGI's expertise in glass packaging allows us to effectively serve this growing market

RR: How so?

RK: India is a becoming a major manufacturing hub for the world. The markets in Europe, the United States of America, and Japan are ageing with higher average ages in those regions. Because of this, India has become a hub. Most of our population is under 30 years of age. While many are currently studying in schools and colleges, they will soon enter the workforce. Manufacturing is key to engaging this young workforce, and cosmetics is one of the industries contributing to this growth.

RR: What strategies is AGI implementing to stay competitive in the glass industry?

RK: In the glass industry, maintaining competitiveness requires significant capital investment. AGI addresses this by focusing on two key areas: optimising internal efficiencies and embracing advanced technology. We're committed to leveraging the best available technology to produce high-quality glass products that meet stringent global standards. This commitment is crucial for staying ahead of the curve and maintaining a strong competitive position in the global market

RR: Which segments are you investing in?

RK: Our capital expenditure is focused on enhancing our operational efficiency and expanding production capacity through strategic de-bottlenecking initiatives. This investment ensures we can continue to provide high-quality glass products to meet the growing demands of the market.

RR: Who was your target audience at the Cosmoprof show, and how do you plan to support them?

RK: At Cosmoprof, we were focused on engaging manufacturers of primary and secondary packaging who export to key markets like the US and Europe. We understand the specific challenges these businesses face, such as meeting stringent quality standards and navigating complex regulations. We offer a range of support services, including technical assistance, manufacturing expertise, and access to our advanced production capabilities, to help them overcome these challenges and thrive in the global marketplace.

Khosla: Staying competitive in the glass industry demands major capital investment

RR: What about exports? How do you compare to Chinese competition?

RK: We see significant export opportunities, particularly as environmental regulations become more stringent in regions like Europe and the US. While China remains a key competitor, AGI is strategically positioned to serve global markets due to our favourable political and economic environment.

RR: What is your company's strategy regarding the domestic market versus exports?

RK: Companies adopt different strategies. Some companies focus heavily on exports to boost revenue or profit, but that’s not our approach. For us, the Indian domestic market is a top priority. Of course, we are a commercial organisation, and to remain profitable. However, any company that caters to the domestic market is generally on a stronger footing as opposed to one that banks on exports.

RR: What does high-quality glass production mean in today’s time?

RK: High-quality glass production today means meeting stringent quality standards across diverse applications. This includes precise dimensions, consistent quality, superior strength, and aesthetic appeal. AGI is equipped to deliver this level of quality across various segments, from alcohol bottles and decorative glassware to comprehensive packaging solutions for the cosmetics industry.

AGI leverages a favourable political and economic climate to serve global markets.

RR: What do you mean by total solutions?

RK: By 'total solutions,' we mean providing a complete, ready-to-fill packaging solution. For example, a perfume bottle requires multiple components, including the glass bottle itself, the cap, and any decoration like metallic printing. We provide all of these, so the customer simply needs to fill out the product and apply the closure

RRajesh Khosla: Security caps and closures

We have a dedicated manufacturing plant and team for security caps and closures. This is important to the liquor industry. There are two reasons. One is to protect the revenue of the government, which is public money. The other reason is health because spurious liquor can be packed and contaminated, which is a serious problem.

In India, every state has its excise policy. What happens is that bottles are counterfeited, by collecting used bottles, recycling them by removing the cap and using a counterfeit cap. This gives easy access to a counterfeiter to make a new cap. The closures we produce have high security, high pullout, and high non-refillable. In other words, they have features that will destroy the closure completely.

The counterfeiters cannot use any of the components of the caps that AGI produces. They must buy new caps; in which they have to approach us or invest. Investment is not possible because the caps we produce are made using high-end technology. Counterfeiting is rampant in states like Bihar and Gujarat.

The only way to counter counterfeiting is to make closures which need high investment, out of reach of the counterfeiters, and so complex that the counterfeiters cannot use any of the parts once used. We are pioneers in this technology, and we are also making inroads into non-liquor products in the food and pharmaceutical industries which are also seeing a lot of counterfeiting.

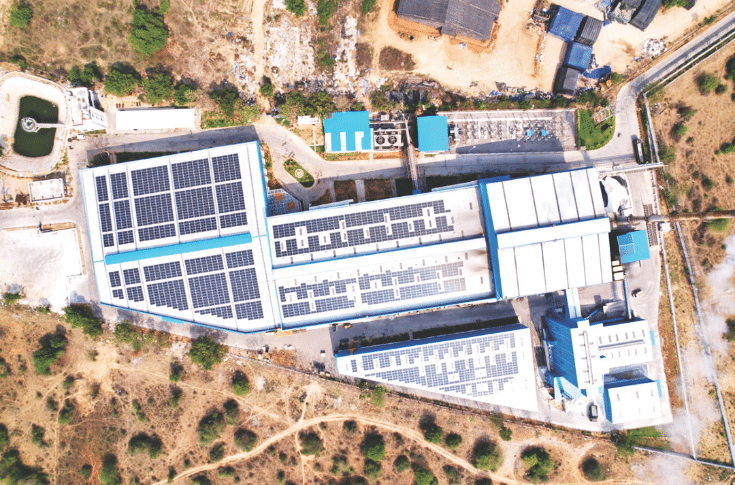

RR: Tell me about your factories.

RK: AGI operates three specialised manufacturing facilities for glass bottles. Our Bhongir plant focuses on packaging for the cosmetics and commercial sectors, while our Hyderabad facility is dedicated to commercial glass production.

RR: What kind of innovations are you working on at your R&D centre?

RK: At our dedicated R&D centre, recognised by the Government of India, we're driven by a commitment to both sustainability and enhanced product performance. We're exploring innovations such as optimising serum bottle designs to reduce waste and developing specialised glass packaging for skincare and haircare with advanced coatings and structural designs to improve product protection and shelf life.

RR: Very interesting, so your R&D is not just working on products …

RK: Absolutely correct. Our R&D takes a holistic approach, focusing not only on product innovation but also on optimising our environmental impact and operational performance. This includes research and development in areas such as sustainable materials, waste reduction strategies, and process improvements to enhance efficiency.

RR: At sustainability conferences, we rarely hear a voice from the glass packaging industry. How do you view your position in the packaging industry compared to other materials like flexible packaging or PET?

RK: Glass occupies a distinct position in the packaging industry, particularly for applications requiring purity, premium presentation, and sustainability. While other materials like flexible packaging and PET serve different purposes, glass is indispensable for products like perfumes and vials, where its inertness and recyclability are crucial. We don't compete directly in those overlapping areas; we focus on delivering the unique benefits that only glass can provide.

RR: What is your perspective on the environmental and health impacts of plastics? Isn’t the time apt, to inform all the stakeholders: the customers, the government, and others?

RK: Absolutely. Be it pharmaceuticals or beverages, everyone talks about the plastic industry in the context of the environment. While much attention is given to the environmental implications of plastic waste, we must also focus on the long-term health risks posed by microplastics entering our bloodstream. With a population of 140-crore, it’s important to ensure that everyone is healthy, productive, and contributing to the economy.

RR: When it comes to messaging, is there a mantra that you would like to give on behalf of the glass industry?

RK: We are yet to form those catchy mantras. As the president of the All-India Glass Manufacturers' Federation (AIGMF), I believe we need to have a collective discussion within the industry. However, the overarching message is clear: if we don’t open our eyes today, we’ll pay a heavy price tomorrow. It’s critical to inform all stakeholders to give packaging the respect it deserves.n